free cash flow yield private equity

Arzac in his We can also build a definition of free cash flow by aggregating the following. Obviously they are measuring different things but are there any situations.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Id love any insights you can provide into the following questions.

. COWZs free cash flow yield of 4 is double IUSV and SPY at 2. The trailing FCF yield for the SP 500 rose from 11 on 33121 to 22. Whats left is often called free cash flow which is then available to be used perhaps to pay a dividend or expand the businessTo turn this into an equity free cash-flow yield you divide it by.

If the company has 10 shares available at 1000 apiece the market capitalization is 10000. LFCF yield LFCF Value of equity. Free cash flow yield is computed as the ratio of free cash flow to the initial value of the asset.

Can earnings yield proxy FCF yield. In corporate finance free cash flow to equity FCFE is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacks after all expenses reinvestments and debt repayments are taken care of. Free Cash FlowA Working Definition In this book the term free cash flow has very specific connota-tions that differentiate it from the more generalized concepts of cash and cash flow Professor Enrique R.

Free Cash Flow Yield 16932 Billion 21516 Billion. The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn against its market. Calculate the amount of revenues generated by a certain investment over a year.

In the next section we define the concepts of free cash flow to the firm and free cash flow to equity and then present the two valuation models based on discounting of FCFF and FCFE. The index-level yield is calculated as the weighted average using the fair value of each constituent. High free cash flow yield shares are sometimes seen as possible takeover targets for private equity groups.

The subsequent sections turn to the vital task of calculating and. The Shareholder Yield philosophy. The current price of the stock multiplied by the total number of shares available.

To calculate the free cash flow yield of a stock you need to know how much it would cost you to buy the entire company right now market capitalization. In that example your Cash Yield would be 10 500050000. We also explore the constant-growth models for valuing FCFF and FCFE which are special cases of the general models.

EV market value of equity common preferred market value of debt - cash also known as net debt. Which metric do you prefer. For example if an investment provides 5000 per month in revenues then the annual revenues are 60000.

The price to economic book value PEBV ratio for COWZ is 14 which is less than the 18 for IUSV holdings and nearly half the 26. The down payment would usually be the net property investment which is the propertys cost minus the amount you borrowed. Would anybody be able to help me draw the realtionship between these two metrics.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. A free cash flow yield of over 10 per cent is considered to be high. It ignores capital gains.

Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. Take the before-tax figure for this calculation. Suppose that you bought a property and your net cash flow was 5000 and the cash invested in your property was 50000.

This helps private equity lenders determine the profitability of their investments. Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. It is also referred to as the levered free cash flow or the flow to equity FTE.

LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. This is because the free cash flow can be used to support the large amounts of debt that private equity buyers tend to use to finance their takeovers. Equity Indices Methodology Attachments 0 Page History Page Information Resolved comments View in Hierarchy.

The ratio is calculated by taking the. TextFree cash flow yield_t.

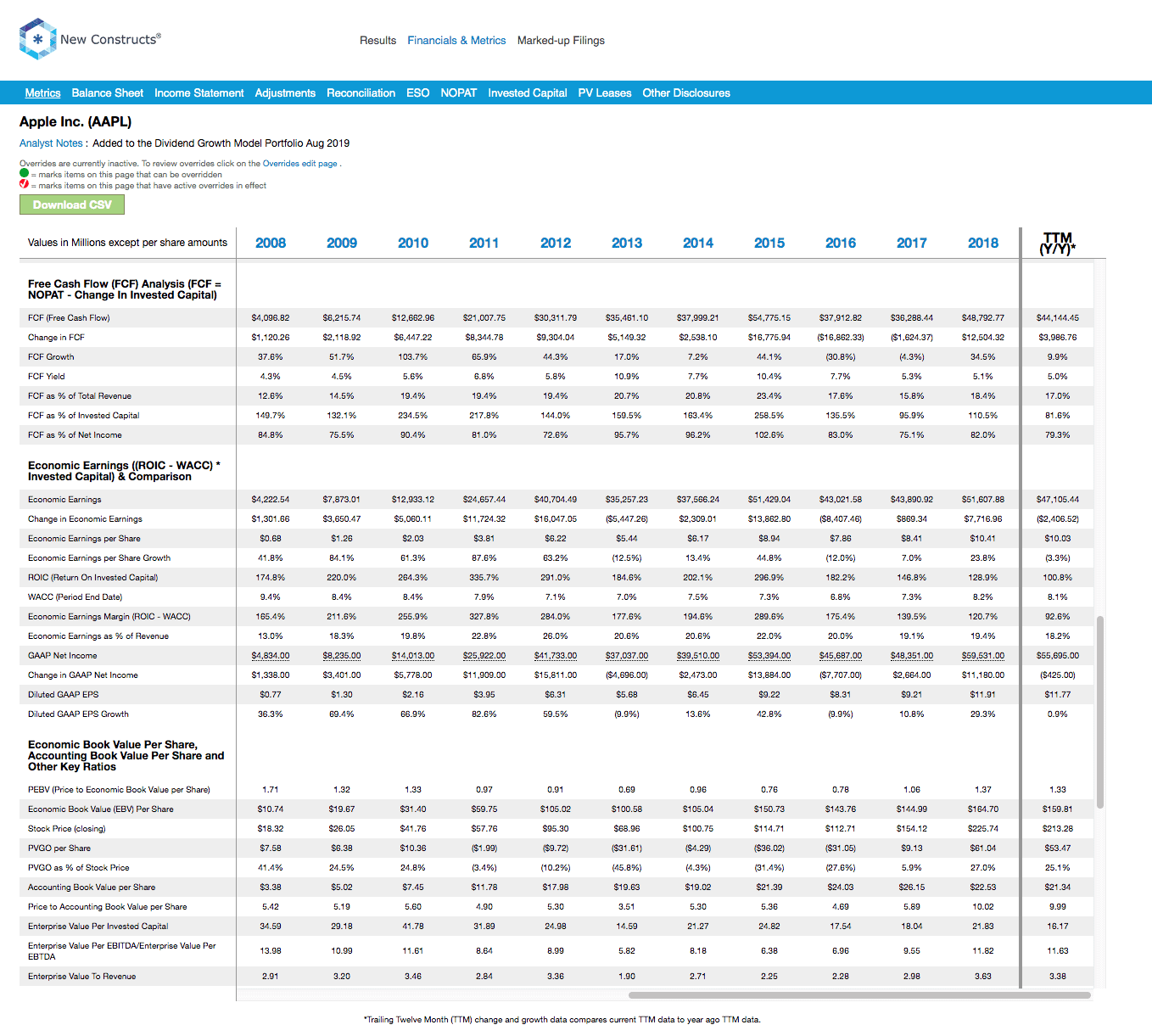

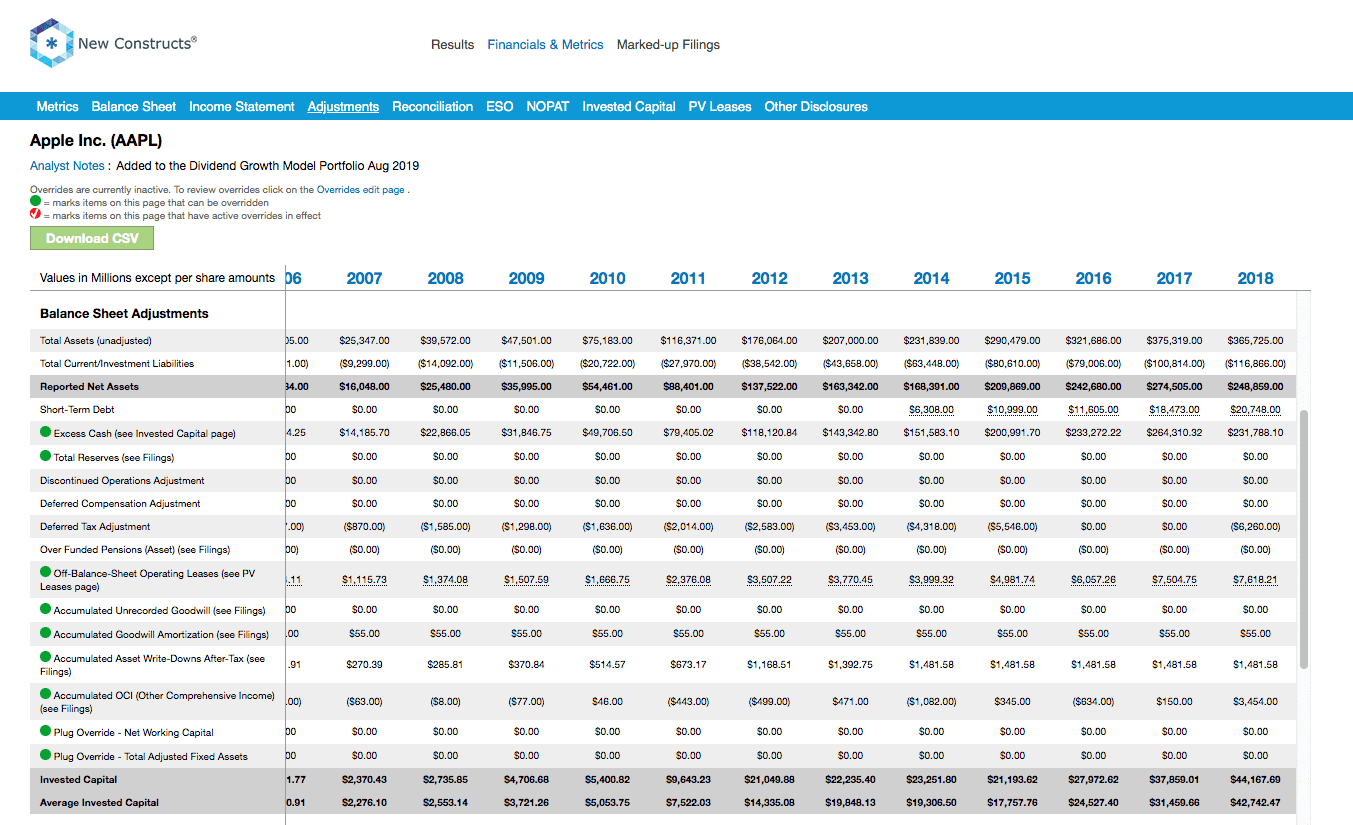

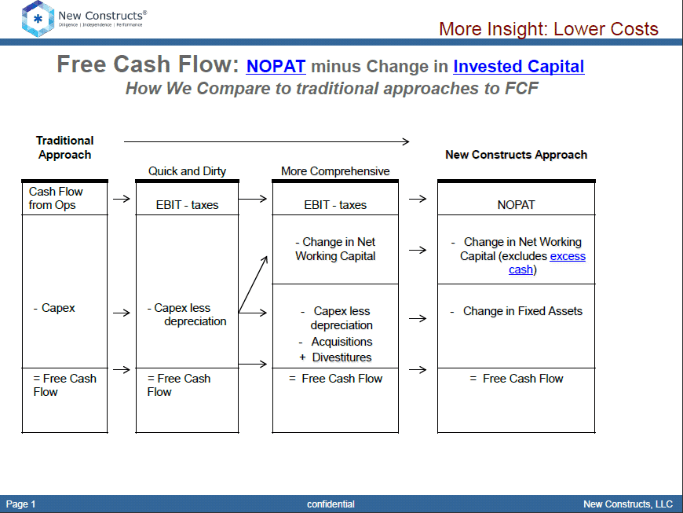

Education Metrics Fcf New Constructs

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Explained

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Education Metrics Fcf New Constructs

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Yield Formula Top Example Fcfy Calculation

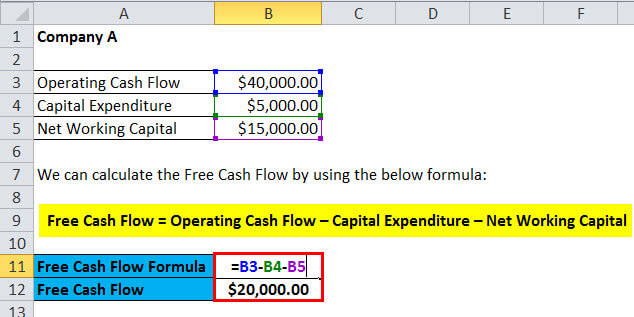

Free Cash Flow Formula Calculator Excel Template

Education Metrics Fcf New Constructs

Free Cash Flow Formula Calculator Excel Template